By D. Kenton Henry

Editor, Agent, Broker

HealthandMedicareInsurance.com

11 September 2024

Welcome, fellow boomers and others blessed to have lived long enough to find yourself here. I believe you recognize that the information in my blog posts can contribute to this leg of our journey being the longest and most rewarding. I’m right here with you and doing my best to make it so for all of us. Coming changes in 2025 Medicare plans are significant, so please read this and feel free to take notes. They could impact you and probably will.

An Annual Notice of Change (AOC) from your Medicare Part D prescription drug plan or a private insurer’s Medicare Advantage plan is due you. It will arrive in the United States mail and, per Medicare rules, by September 30th. So, like the pretty woman in the image above, open it and read it. It outlines how much your premiums, deductibles, and co-pays will differ in the coming year. Will your drugs be covered, and will your current drug plan even be available? We don’t yet know. Mutual of Omaha notified agents and brokers that it is withdrawing altogether from the Part Drug plan market beginning January 1. If you are currently with them or have any other plan that is exiting the marketplace, follow the instructions in the next paragraph.

According to eHealth, a mere 36% of those surveyed claim the AOC to be “readily understandable.” The author of the attached article recommends you spend at least 30 minutes reviewing it. However, if you finish this article, you can cut that time considerably. If you have finished all and still feel you are among the remaining (up to) 64%—please call me @ 281-367-6565.

This article is a follow-up to my last blog post on September 3rd. “MAJOR CHANGES IN MEDICARE PART D DRUG PLANS ARE COMING OUR WAY (what we know. and one thing we don’t know).” To read it, please click on this link. (if necessary, copy and paste it in your browser’s URL box and hit enter):

https://healthandmedicareinsurance.com/2024/09/03/

Well, now we know more of the potential compromises mentioned or alluded to in that article. All of these are covered in detail in Feature Article 1 below.

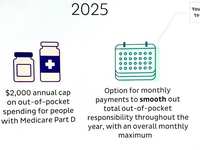

The changes addressed here are largely because of the new $2,000 per year limit on Medicare Part D drug costs in 2025 (versus $8,000, plus 5% thereafter, in 2024). That leaves Medicare Part D insurance companies looking for ways to compensate for the additional costs shifting from you to them. Come January, you will meet a new deductible of up to $590 (from $545) for applicable drugs. Typically, your plan will apply this to brand-name drugs and not Tier 1 or Tier 2 generics.

Beyond that, the Gap, commonly referred to as the “donut hole” (in which you were previously responsible for 25% of your drug costs), has been eliminated entirely. You will have entered the “Initial Coverage” phase in which your elected drug plan will pay 65% of your applicable drug costs, and you will pay 25%. The Manufacturer (pharmaceutical company) will discount the remaining 10%. When you hit your maximum Out-of-Pocket (OOP) threshold of $2,000, you enter “Catastrophic Coverage”. At that point, your plan will pay 60%. Reinsurance (CMS, the Center for Medicare Services, i.e., the government) will pay 20%, and the Manufacturer will pay the remaining 20%. You will pay $0.

This, of course, sounds very well and good! And for those utilizing large quantities of drugs, or expensive drugs, this will indeed be of great benefit. But in what ways may the drug plans “compensate” for the additional costs they will bear? Much of such was referenced or alluded to above. However, please permit me to drill down on potential measures drug plans may take to offset their increased share of your drug cost. *(I am a Medicare Insurance product broker and not a C.P.A. As such, I will not address the impact on the taxpayer of their increased share of Medicare drug costs in this forum. wink. wink 😉

The drill down:

In addition to the higher deductible, higher premiums may be in store. But it could have been a lot worse. CMS did health insurance companies a favor with a “premium-stabilization” plan. In 2025, they will give them a subsidy in exchange for not “slapping members with exorbitant premium hikes. So, “what might have been a 40%, 50%, or higher premium increase may only be as high as 25%. Either way, it will be a sticker shock when some see how their premiums changed.” *(a paraphrase a quote in Feature Article 1)

The Kaiser Family Foundation says the average cost of a stand-alone Part D drug plan is $43. I have seen previews of premiums which will be $0, but others, have risen. In addition to your premium, co-pays for your drugs could go substantially higher. If your drug plan is obligated to charge you less for (or cover more of) a particular drug, are they simply going to charge you more for others?

And what about “Value Added Benefits” (VAB) available in some Medicare Advantage Plans? These include vision, hearing, and dental services. Other examples include acupuncture, bathroom safety devices, and wigs for hair loss. And what about your gym membership? Embedded dental insurance has been dramatically cut back or removed completely.

VAB are not covered by Original Medicare. Medicare Advantage has been able (often along with a $0 premium) to offer these things as an additional incentive to encourage enrollment in their plans. However, because you left Original Medicare and “assigned” the administration of your benefits and claims to the Advantage company when you enrolled, your plan can choose to provide these ancillary benefits that Original Medicare does not. Or they can choose to cover them no longer. This discretion is on their part because the provision of VAB benefits is not codified in law or per CMS regulation. Resultingly, they are not guaranteed. They are optional benefits that the plans have the right to withdraw at any time. I hope you can continue to “workout” at the gym, at your plan’s expense, in 2025 and beyond. But be prepared to purchase a home gym kit if you learn your membership is downgraded or your Advantage plan disappears entirely.

With no obligation, please feel free to contact me for clarification of these relevant issues and additional guidance in navigating the Medicare system and the changes referred to here. I’m in Medicare with you. I am a “Boomer” who has spent the better part of his life in the medical insurance market. For years, I have assisted individuals, families, and businesses in identifying and enrolling in health insurance plans that came as close as I could get them to fully meeting their medical insurance wants and needs.

To sum things up, I work for my clients. I work for you. Not the insurance company. I study, take their tests, and “certify” to represent their products each calendar year. I just completed certifying with approximately 14 companies in preparation for marketing their products in 2025. They do not pay to renew my licenses or my Errors and Omissions insurance, nor do they cover my office insurance and expenses. Neither they, nor anyone else, pay me wages or a salary. And that is great! I knew and understood those terms when I went out on my own. And that is precisely why I did it. I did not want to be beholden to the insurance company.

After becoming independent, the list of companies I was contracted with grew to over 40 during the 1990s. That number has changed as many of those companies went the way of the steam engine with “Obamacare” and all the red tape and regulations that come with it and remaining in the industry. But I persist. I remain positioned to provide you with virtually every available Medicare and health insurance product in your region.

In conclusion:

If you’re reading this, chances are you remember Jim Rockford (a private detective, portrayed by the actor the late James Garner) in his TV show, The Rockford Files (you can hear the opening music now, can’t you?). In the prelude to each episode, you see his cassette recording answering machine and hear the message, “This is Jim Rockford. At the tone, leave a message …”.

Should you get mine, please do the same. Or you may simply text me.

Donald Kenton Henry

Editor, agent, broker

Office: 281-367-6565

Text my cell 24/7 @ 713-907-7984

Email: Allplanhealthinsurance.com@gmail.com

Https://TheWoodlandsTXHealthInsurance.com

Https://Allplanhealthinsurance.com

Please follow me @ Https://HealthandMedicareInsurance.com

************************************************************************

FEATURE ARTICLE 1

FORTUNE

Richard Eisenberg

Updated Mon, Aug 26, 2024

Why this year’s Medicare Annual Notice of Change will be vital reading for beneficiaries

In this article:

If you’re on Medicare, you’ll be getting one or two Annual Notice of Change letters in your mail or email this September about your 2025 coverage and costs. You may be tempted to ignore what looks like junk, as nearly a third of recipients do, according to an eHealth survey.

Don’t.

“So often, a person who is quite happy with their plan and doesn’t bother to look at their Annual Notice of Change then gets a nasty surprise in January” when the plan’s new costs and coverage kick in, says Danielle Roberts, author of 10 Costly Medicare Mistakes You Can’t Afford to Make and founding partner of Boomer Benefits, which sells Medicare policies.

What is an Annual Notice of Change?

An Annual Notice of Change from your Medicare Part D prescription drug plan or a private insurer’s Medicare Advantage plan lays out how much your premiums, deductibles, and co-pays will differ in the year ahead and whether the plan will even be offered. (Medigap plans don’t send these notices because they don’t change much year to year.)

An Annual Notice of Change from your Part D plan also says whether your prescriptions will be covered and, if so, how much you’ll pay. A Medicare Advantage Notice of Change will tell you if your doctors and hospitals will remain in the plan’s network.

While this information is always essential to make smart choices during Medicare’s eight-week open enrollment period (Oct. 15 – Dec. 7), experts say reading your Annual Notice of Change is especially important in 2024.

“There is an excellent chance that something is changing on your plan,” says Roberts. “This year, more than ever, we can expect big changes in the plans.”

Surprising effect of the $2,000 prescription drug cap

That’s largely due to a major Medicare change coming in 2025: the new $2,000 cap on out-of-pocket costs for prescriptions covered by a Part D plan.

Since Part D health insurers will be on the hook for more prescription costs due to the cap, they’ll be looking for ways to compensate.

That could mean higher premiums (currently $43 a month for stand-alone plans, on average, according to KFF), deductibles, and co-pays—possibly substantially higher than in 2024.

“I have been very, very concerned about what the $2,000 cap was going to do to Part D premiums,” says Roberts.

The prescription drug change in 2025 could also lead to your Part D plan no longer covering certain medications you take or raising prices of ones it will.

Medicare Advantage plans—some facing profit squeezes currently—often include Part D coverage, so they may respond to the $2,000 cap by trimming or eliminating benefits to keep their popular $0 premiums intact, experts expect.

As a result, your Medicare Advantage benefits that original Medicare can’t offer—such as dental, vision, hearing, and gym memberships—could be less attractive than in 2024, or possibly gone entirely.

“It really will be important to understand what’s changing in the coming year in my current plan and does the plan still fit?” says eHealth CEO Fran Soistman. “Does it still provide the value that it did when I elected to go in it in the first place?”

Reading and understanding the Notice of Change

Your Annual Notice of Change will tell you—if you can understand it.

Only 36% of Medicare beneficiaries surveyed by eHealth said their Annual Notice of Change letter is “readily understandable.”

Figure on spending about 30 minutes closely reading your Annual Notice of Change to see exactly what will be different in 2025 and whether you’ll want to switch plans or coverage next year as a result.

During open enrollment, you can switch from your current Part D plan to another, from your Medicare Advantage plan to another, from Medicare Advantage to original Medicare as well as from original Medicare to a Medicare Advantage plan.

But don’t feel compelled to switch plans just because your Annual Notice of Change says your premium will go up a little or a benefit will be trimmed slightly.

“If there’s a modest benefit decrease or premium increase, but they’re satisfied with what the carrier is providing, people shouldn’t make a change,” Soistman says.

However, he added, if a medication you take will no longer be covered or your physician or hospital won’t be in network, that’s an important change that may persuade you to switch coverage.

The Medicare Plan Finder on Medicare’s site will let you compare Part D and Medicare Advantage plans for 2025.

And, as Philip Moeller writes in the forthcoming revised edition of his book, Get What’s Yours for Medicare, if your Medicare Advantage plan won’t include your favorite doctor or hospital in its network in the year ahead, it’s legally obligated to work with you to identify other physicians or hospitals in its network that you’d like.

A new program to help avoid big premium hikes

To help prevent drastic Part D premium increases, the government’s Centers for Medicare and Medicaid Services recently threw a bone to health insurers with a premium-stabilization plan.

Medicare will provide a special subsidy to those insurers for 2025 in exchange for avoiding slapping members with exorbitant premium hikes.

“It should take what might have been a 40%, 50%, or higher premium increase down to probably 25%,” says Soistman. “It’s still going to be a bit of sticker shock when some people see how their premiums changed.”

Roberts says, “I’m still somewhat concerned about premiums, but I feel a little better after the stabilization program announcement.”

Getting help if your Medicare plan will change

After reading your Annual Notice of Change, you may want to get help deciding on the right Medicare plans for 2025 and to understand the implications of coming changes to your plans.

You can ask a Medicare broker or agent for assistance; there’s a directory at the National Association of Benefits and Insurance Professionals site. The sooner you do, the better, since agents and brokers will be swamped near the end of open enrollment.

“At Boomer Benefits, we have to stop taking new requests after Thanksgiving,” says Roberts.

If one of your prescriptions won’t be covered by your Part D plan in 2025, call your doctor to see if another covered medication would be okay or if you should find a new plan that includes it, Roberts advises.

For information about Part D and Medicare Advantage plans without purchase recommendations, try your State Health Insurance Assistance Program or visit Medicare’s site or call Medicare’s toll-free number.

More time for open enrollment?

Soistman believes all the changes coming to Part D and Medicare Advantage plans for 2025 will push back the arrival of the Annual Notice of Change documents to the last two weeks of September.

If so, this will give people with the plans less time than normal to read the notices before open enrollment.

The eHealth agency has asked the Centers for Medicare and Medicaid Services to extend open enrollment by about five days to give beneficiaries, insurers, and Medicare brokers more time. Boomer Benefits favors the extension, too.

So far, the government hasn’t responded to eHealth’s proposal.

Could the 2025 open enrollment become Medicare’s equivalent of the Department of Education’s FAFSA financial-aid form fiasco of chaos and confusion?

“I don’t think it will be quite as drastic. I think it is going to be a year of change, though,” says Soistman. “And change is hard for people.”

*********

Please follow D. Kenton Henry @ Https://HealthandMedicareInsurance.com