By D. Kenton Henry

Editor, HealthandMedicareRelatedInsurance.com

Agent, Broker

28 January 2025

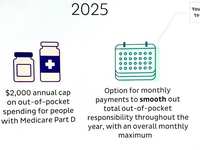

Hello again, and welcome to 2025! Early last October, just prior to the Medicare Annual Election Period (AE), I informed you of the many changes coming to Medicare Part D Prescription Drug Plans in the coming calendar year in which we now find ourselves. I explained the pros and cons that many of you are now experiencing in real time. On the positive side, I am certain many are celebrating that their annual drug costs (for Part D covered drugs) can never go beyond the new annual maximum out-of-pocket (OOP) of $2,000! And, hopefully, you are not experiencing the negatives—such as learning your Rx drug (which was previously covered) is no longer or its price has increased dramatically! Once again, we realize the government can giveth or taketh away.

But there is one thing in which you have a certain amount of control, and this is the ideal time of year to exercise that control. During the AEP, insurance companies, agents, and brokers work overtime seven days a week to see that their clients, and prospective clients, are guided to the Medicare Advantage and Part D Drug plans that best meet their needs. To do this correctly, an agent must understand the client’s needs and objectives and then do, what is often, extensive research to ensure a person’s drugs are covered and they have access to their preferred providers. In some cases, this can take minutes and, in others, hours over repeated phone calls. In most cases, you won’t get the latter from a company employee on the end of an 800 number, but you will get it from me.

Now that the AEP ended December 7th, agents have much more time to assist you in improving the cost of your Medicare Supplement coverage. As you may know, Medicare Supplement is not subject to annual enrollment periods in Texas or most states. What this means, is you can re-shop your Supplement coverage to find identical (or improved) coverage 365 days per year. The incentive for doing so is that you may save 30% or more in premiums! Because Medicare Supplement premiums go up each year as we age, it doesn’t take too many years before most of us begin to wonder if our premium is still reasonable or competitive. The reality is, if your policy is three years or older, you will indeed safe significantly by switching to a policy with the same letter designation, e.g., Plan G. I have many clients whose policy premiums had increased to well over $300 per month that I was able to lower (with new coverage) to less than $200 per month!

Additional reasons to re-shop now are that a few “A” rated companies are particularly interested in expanding their block of business. This does not imply a compromise in the quality of their customer service or rate stability. It simply means that through prudent management and staff expansion, they can be more competitive, significantly lowering your premium. Additionally, you may now have a spouse, or in some cases, simply another adult living with you—making your new policy available for a “Household Discount”. Typically, these discounts can lower your premium 7-12%, and—if the other person is covered by the same company—that discount will apply to their existing policy also!

So what is the catch? The catch is that now that you have been in Medicare Part B 6 months or more, you must go through underwriting and be approved for the new coverage based on your current health and relatively recent health history. The bottom line is, if your current conditions are well controlled with medication, you do not suffer from any chronic condition that poses a long-term liability to the insurance company, and you have no pending surgeries or hospitalizations—you are a good candidate for replacement coverage. The worst scenario is you are declined. In this case, all you are out of is the small amount of time you took to complete the application.

THE FOLLOWING IS A SYNOPSIS OF THE PROS AND CONS OF RE-SHOPPING YOUR COVERAGE:

Re-shopping a Medicare Supplement (Medigap) policy can provide several advantages for recipients, especially if their needs or circumstances have changed since they first enrolled. Here are the key benefits:

1. Cost Savings

- Premium Reduction: Medigap premiums can vary significantly between providers for the same coverage. Shopping around may uncover lower premiums for the same plan (e.g., Plan G or Plan N).

- Health Status Discounts: If your health has improved since your initial enrollment, you might qualify for a lower premium rate with another insurer.

- Household Discounts: Some insurers offer discounts if multiple members of the household enroll in their Medigap plans.

2. Better Coverage Options

- Change in Needs: If your healthcare needs have increased or decreased, you might find a plan that better aligns with your current situation, such as switching from a high-deductible plan to one with lower out-of-pocket costs.

- Additional Benefits: New Medigap plans might include perks like fitness programs, telehealth, or wellness benefits that weren’t available when you initially enrolled.

3. Access to New Insurers

- Competitive Market: New insurers entering the market may offer attractive rates or better customer service than your current provider.

- Provider Reputation: Switching to a more reputable insurer can improve your overall satisfaction and ensure reliable claims processing.

4. Avoiding Rate Increases

- Age-Based Increases: Some policies increase rates as you age. Shopping around may allow you to switch to a community-rated policy where premiums are based on a group average rather than individual age.

- Annual Adjustments: If your current insurer has raised premiums significantly, exploring alternatives can help you lock in a more stable rate.

5. Improved Customer Service

- If your current insurer has poor customer service or limited support, switching to a provider with higher satisfaction ratings can enhance your overall experience.

6. Medicare Advantage Comparison

- While re-shopping Medigap policies, some recipients may realize that a Medicare Advantage (Part C) plan is more cost-effective or suitable for their needs. These plans often include additional benefits like dental, vision, and hearing coverage.

7. Regulatory Benefits

- Guaranteed Issue Rights: In some situations (e.g., losing coverage or moving), recipients have guaranteed issue rights, allowing them to switch Medigap plans without medical underwriting.

- Trial Rights: If you tried a Medicare Advantage plan for less than 12 months and decide to switch back to Original Medicare, you may have a guaranteed right to re-enroll in a Medigap plan.

8. Customizing for Future Needs

- Planning ahead for potential healthcare changes can ensure that you are prepared for costs that might arise later, such as skilled nursing care or extensive outpatient services.

Considerations When Re-Shopping

- Medical Underwriting: Outside of guaranteed issue periods, you may need to answer health questions, which could affect your eligibility or rates.

- Plan Standardization: All Medigap plans with the same letter (e.g., Plan G) offer identical core benefits, regardless of the insurer, making it easier to compare prices.

- Timing: The best time to switch is typically during your open enrollment period or when you have guaranteed issue rights.

By re-shopping their Medigap policy, Medicare recipients can ensure they are getting the best value and coverage for their evolving needs.

I am an independent agent with more than three decades in the medical insurance industry. As I have aged, so have my clients, and Medicare-related insurance (Supplement, Advantage, Part D) has become my specialty. I represent virtually every “A” rated insurance company in Texas as well as three others. I provide objective advice based on empirical numbers inclusive of costs and satisfaction surveys.

Significantly, I do not charge a fee for my service. You are charged no more for acquiring a product through me than if you went in the front door of the insurance company whose product you elected and acquired it directly from them!

Please allow me to assist you in lowering the cost of your Medicare-related insurance. I look forward to working with you!

D. Kenton Henry

Office: 281-367-6565

Text my cell 24/7 @713-907-7984

Email: Allplanhealthinsurance.com@gmail.com

Https://HealthandMedicareInsurance.com

Https://Allplanhealthinsurance.com